It’s not just about the Offer…It’s about the long term Value

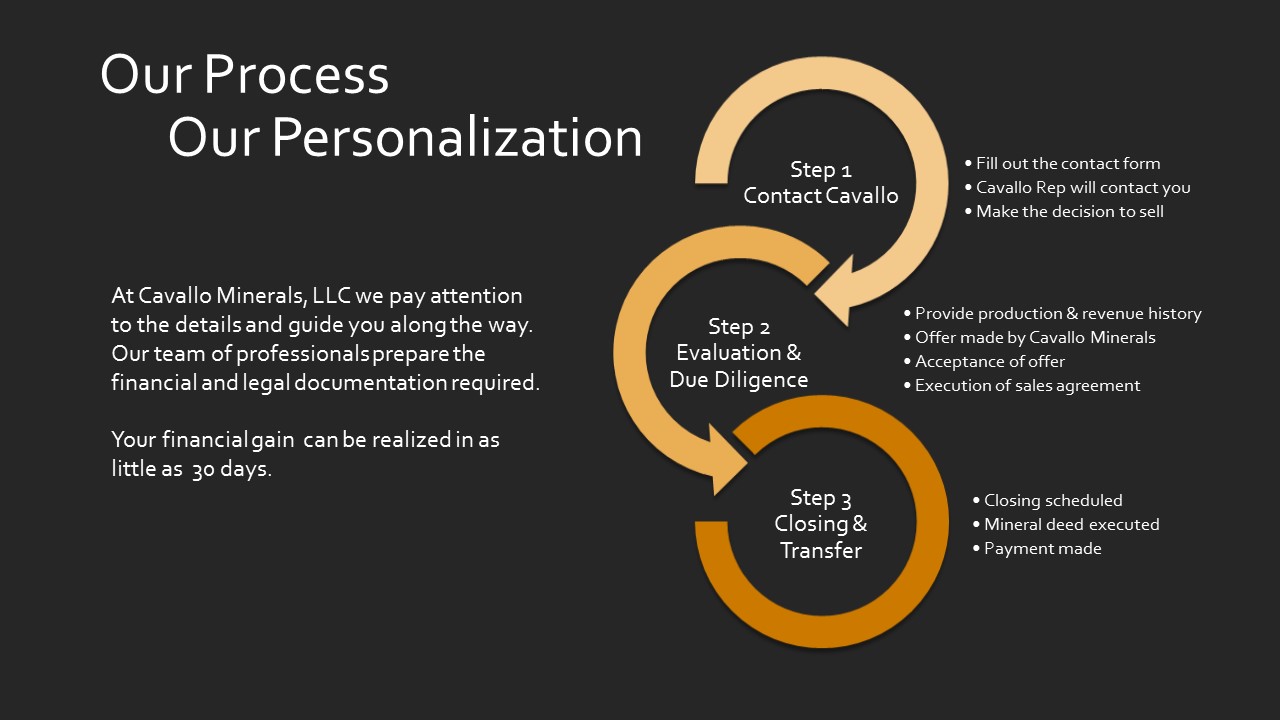

Once you have made the decision to sell your minerals, you and Cavallo Mineral Partners, LLC will jointly begin the process of gathering the information required for an evaluation.

As the transaction process itself can be difficult to undertake, our in-house team will handle the entire process from evaluation, legal documentation to closing the transaction. We strive to make this process smooth and beneficial for all. You will not incur any costs to complete this transaction.

The more information you provide us regarding your parcel, the faster we can complete our evaluation and due diligence. This includes:

• The oil and gas lease agreement covering your producing property.

• Or a lease and/or property description for non-producing properties.

• The three most recent monthly check stubs for producing properties.

• Order for Payment, title searches, mortgage information and other source documentation

• Maps and any other pertinent information in your possession.

Upon receipt of the above information, Cavallo Mineral Partners, LLC will start the evaluation process. Our philosophy is to provide potential sellers with a fair assessment of their property based on comprehensive engineering practices and current commodity prices.

We will then contact you with our offer to purchase. Once we agree upon a price we will send for your execution a Purchase and Sale Agreement (PSA) to buy your mineral rights.

Upon return receipt of your signed PSA, Cavallo Mineral Partners, LLC will run title on the property. Upon satisfactory title discovery, we will send you a deed to sign for your mineral rights and then pay you. We offer several payment options for your convenience: wire transfer, cashier’s check sent directly to your bank, or company check sent directly to you.

You can expect to close on the sale of your mineral rights in as little as 30 days.

Like-Kind Exchange and Capital Gain Taxes (Section 1031 of the IRS)

Some sellers may elect to do a Like-Kind Exchange rather than a traditional sale of their property. Cavallo Mineral Partners, LLC will work with you, and your attorney, should you wish to do a like-kind exchange and defer your taxes until a later date.